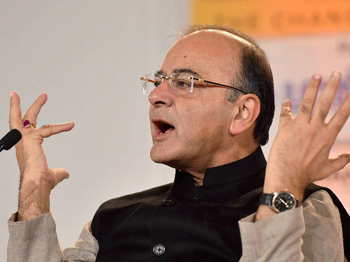

New Delhi, Jan 8: With doubts being raised about demonetisation eliminating black money, Finance Minister Arun Jaitley today said colour of funds has not changed by merely depositing them in banks as the money has now lost its 'anonymity' and can be identified with the owner.

Large amount of cash with banks will lead to lower interest rates, he further said.

"When 86 per cent of a country's currency, constituting 12.2 per cent of its GDP, is squeezed out of the market and sought to be replaced by a new currency, there would obviously be significant consequences of that decision," he said, adding that the queues outside the banks have disappeared and remonetisation has moved ahead.

"The period of pain and inconveniences is getting over. Economic activity is being restored," he said.

Jaitley said demonetisation required both courage and stamina. "The implementation of the decision carried pain. It can lead to short-term criticism and inconveniences. Drop in economic activity on account of the currency squeeze during the remonetisation period would have a transient impact on the economy."

"The fact that large quantum of high denominational currency has been deposited with the banks does not render this money to be legitimate cash. Black money does not change its colour merely because it is deposited in bank. On the contrary, it loses its anonymity and can now be identified with its owner," he said.

The comments follow reports about an estimated 97 per cent of junked notes getting deposited in bank accounts, thus casting doubts on the effectiveness of demonetisation move in checking the black money menace.

The Revenue Department, he said, would be entitled to tax this money. "In any case, the amendment to the Income Tax Act itself provides that the said money, if voluntarily declared or if involuntarily detected, would be liable for differential and high rates of taxation and penalty," he said.

Jaitley further said India suffers as "a hugely tax non-compliant society".

"In the year 2015-16, 3.7 crore assesses of the total population of over 125 crore, filed income tax returns.

"Out of these, 99 lakh declared income below Rs 2.5 lakh and paid no taxes; 1.95 crore declared income less than Rs 5 lakh; 52 lakh declared income between Rs 5 to 10 lakh, and only 24 lakh declared income above Rs 10 lakh.

"No better evidence is required to substantiate that both in the matter of direct and indirect taxes, India continues to suffer being a hugely tax non-compliant society," he said.

Jaitley said the expenditure required for poverty eradication, national security and economic development have to be compromised with on account of tax non-compliances.

He further said, "Tax evasion has been considered as neither unethical nor immoral. It was just a way of life. Several Governments have allowed this 'normal' to continue even though this compromised with larger public interest.

"The Prime Minister's decision (of demonetisation) is intended to create a new 'normal'," he said.

The Finance Minister further said the move seeks to change the expenditure pattern of India and Indians.

"It is obviously disruptive. All reforms are disruptive. They change the retrograde status quo. The demonetisation puts a premium on honesty and penalises dishonest conduct.

"Excessive cash as a medium of exchange is favoured by the underground economy, resulting in non-compliance in tax payments. Mountains of cash money reach tax havens through the hawala route from the original paper currency," he added.

Jaitley further said that cash is the medium which funds bribery, corruption, counterfeit currency and terrorism.

Stating that ethical and developed societies aided by technology have consistently moved towards banking and digital transactions as against the excessive use of cash, he said that reducing cash may not eliminate crime and terrorism but it can inflict serious blow on them.

Jaitley said banks today have a lot more money available in order to lend for growth.

"Since this money constitutes low-cost deposits with the banks, it is bound to bring down the rate of interest. Both these things have already happened. Lakhs of crores, which were floating in the market as loose currency, have now entered the banking system. Not only has the money lost is anonymity, its owners, after being taxed, are entitled to put it to more effective uses," he said.

Jaitley said the Narendra Modi Government wanted to move against the shadow economy and black money from Day-1, and went on to list the steps taken including constituting SIT on black money and international cooperation in sharing information on base erosion and profit shifting.

"Modi Government is determined to act against the shadow economy and black money. All efforts in this regard till date have been fruitful," Jaitley later tweeted.

He said agreement was reached with Switzerland to get details of assets held by Indian citizens from 2019 and tax treaties with Mauritius, Cyprus and Singapore renegotiated to end round-tripping.

"PM Narendra Modi mustered international support against evils of black money since he took over as PM of India," Jaitley tweeted.

He said India enacted a law for dealing with black money outside India and a 'highly successful' Income Declaration Scheme (IDS) for domestic black money holders was launched.

Also PAN card requirement for cash transaction above Rs 2 lakhs has put hurdles on expenditure through black money.

Stating that GST, to be implemented this year, will provide for better indirect tax administration and being a more efficient law will check tax evasion, he said the demonetisation of high denominational currency notes was the big step in the same direction.

With the demonetisation, the size of the banking transactions and consequently the size of the economy is bound to increase, he said, adding that in the medium and long run, the GDP would be bigger and cleaner.

"Money entering into the banking system and officially transacted would give an ample scope for higher taxation -– both direct and indirect. The Centre and the State Governments would both stand to gain. The economy would also be serviced by both cash and highly digitised transactions," he said.

Jaitley said there was a "marked difference" in the approach of Modi and his opponents in dealing with the menace of black money and terror financing.

"The Prime Minister was being futuristic, and thinking of a more modern, technology driven cleaner economy. He is now speaking of cleaning the political funding systems. His opponents want a cash dominated, cash generating and cash exchange system to continue.

"The difference between Prime Minister Narendra Modi and Rahul Gandhi was clear -- the Prime Minister was thinking of the next generation while Rahul Gandhi was only looking at how to disrupt the next session of Parliament," Jaitley wrote.

Stating that there was no social unrest while implementing the major demonetisation decision, Jaitley cited opinion polls conducted by independent media organisations which showed that an overwhelmingly large percentage of people have supported the government's decision.

"The opposition disrupted a full session of Parliament. Their protests have been ineffective. Their exaggerated claims on the disruption of the economy have proved wrong. It is a tragedy that a national party like the Congress decided to adopt a political position, opposing both technology, change and reforms. It sided with black money friendly status quo," it said.

Comments

I like what you guys are up too. Such clever work and exposure!

Keep up the superb works guys I've included you guys to my blogroll.

my webpage Jona: http://yahoo.co.uk

Add new comment